san antonio general sales tax rate

San Antonios current sales tax rate is 8250 and is distributed as follows. San Antonio NM Sales Tax Rate.

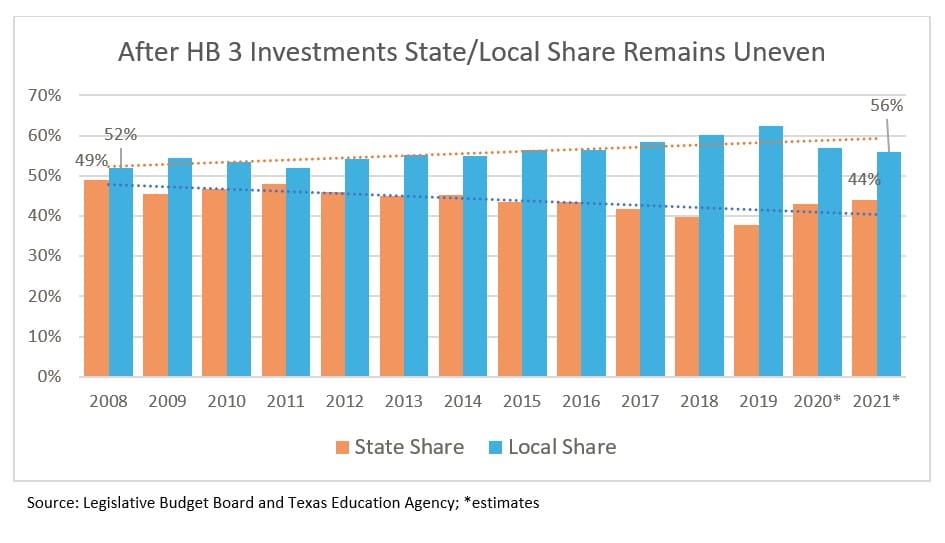

A New Division In School Finance Every Texan

TX Sales Tax Rate.

. Mailing Address The Citys PO. 0125 dedicated to the City of San Antonio Ready to Work. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax. There is no applicable county tax. PersonDepartment 100 W.

4 rows San Antonio. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special tax.

The 78216 San Antonio Texas general sales tax rate is 825. Box is strongly encouraged for all incoming. San Antonio TX 78205.

The 78216 San Antonio Texas general sales tax rate is 825. Sales and Use Tax. This includes the rates on the state county city and special.

The current total local sales tax rate in San Antonio. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. Utility revenues are primarily from CPS.

The December 2020 total local sales tax rate was also 63750. The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The 78216 San Antonio Texas general sales tax rate is 825. City of San Antonio Print Mail Center Attn. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

The San Antonio Texas general sales tax rate is 625. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. The 825 sales tax rate in.

The San Antonio Texas general sales tax rate is 625. 4 rows San Antonio collects the maximum legal local sales tax. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district.

While many other states allow counties and other localities to collect a local option sales tax Texas does. The current total local sales tax rate in San Antonio NM is 63750. The city relies on a combination of utility revenues 30 of fiscal 2021 general fund revenues property taxes 31 and sales taxes 27.

1000 City of San Antonio. The sales tax jurisdiction.

Tax Rates And Local Exemptions Across Texas San Antonio Report

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

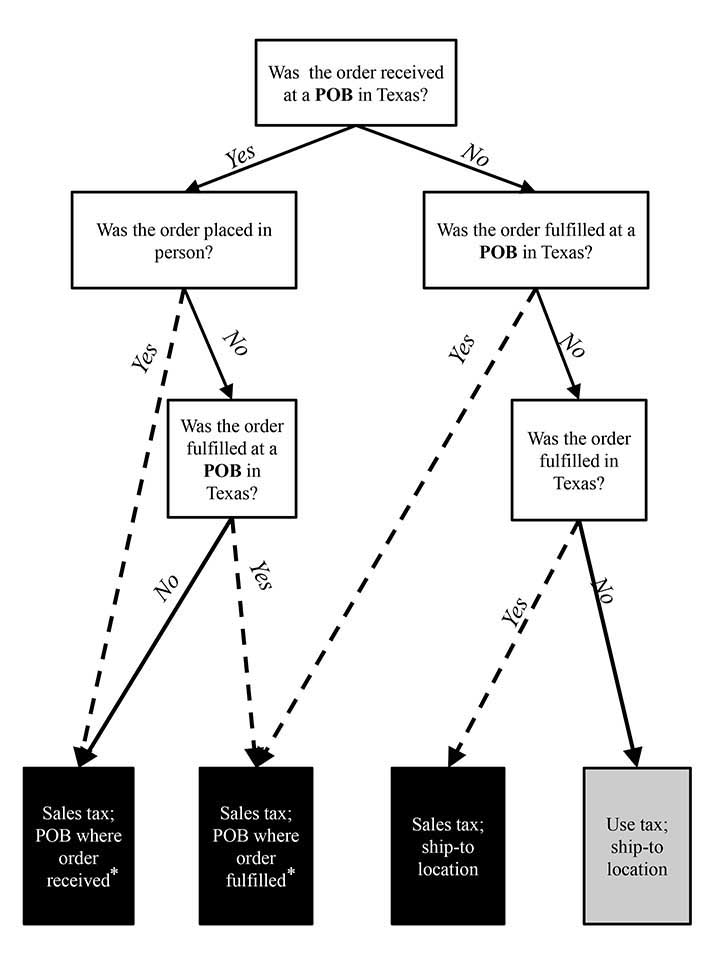

Local Sales And Use Tax Collection A Guide For Sellers

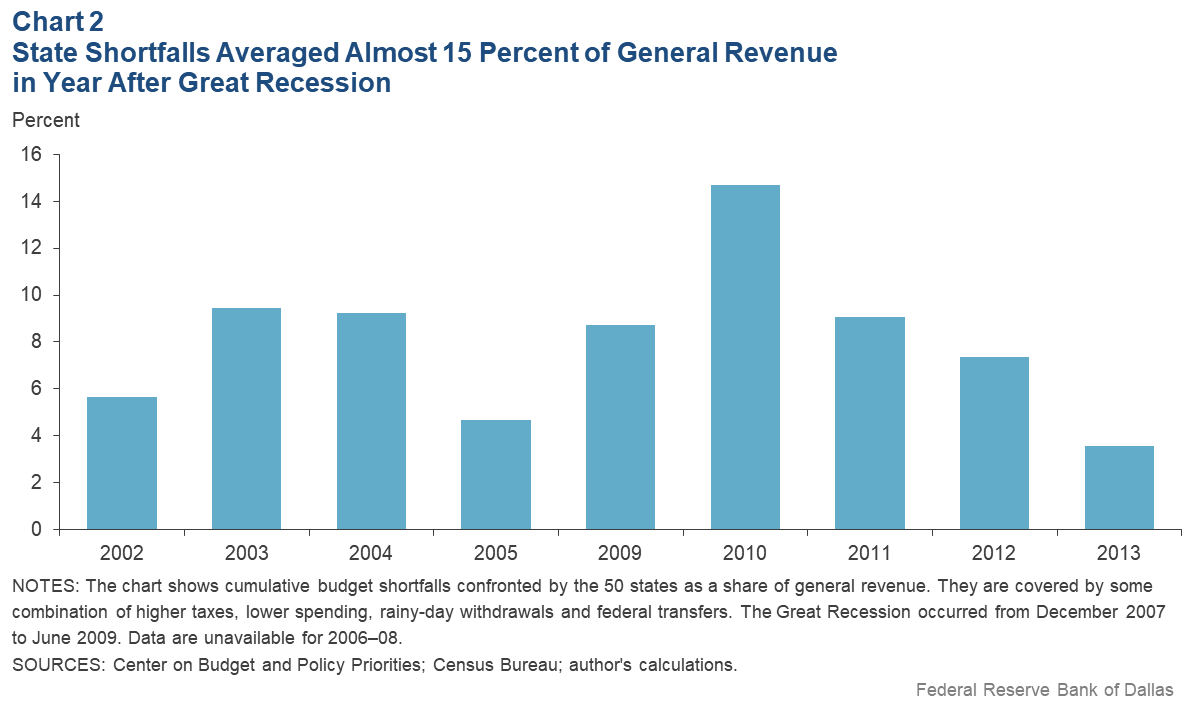

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sales And Use Tax Rates Houston Org

Information About Taxation Of Peru

How To Charge Your Customers The Correct Sales Tax Rates

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Understanding California S Sales Tax

Effective Tax Rates How Much You Really Pay In Taxes

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

San Marcos City Council Sets Maximum Possible Tax Rate Community Impact

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Dallas Homeowners To See Biggest Tax Rate Reduction In Decades Under Budget Proposal

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25