are raffle tickets tax deductible australia

Buy a raffle ticket. Are raffle tickets tax deductible if you dont win.

Felicitation Certificate Template New Sample Business Thank You Letter For Attending An Event Va Donation Letter Donation Letter Template Certificate Templates

However many of these crowdfunding websites.

. It may be deductible as a gambling loss but only up to. Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return. Is the cost of a raffle ticket tax deductible.

In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction. This means that purchases from a charity that involve raffle tickets items or. Thats because you are.

Generally you can claim donations to charity on your individual income tax returns. In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions. Give yourself a chance to win big and feel confident that your funds support vital Red Cross work.

This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. Enter now for your chance to win great prizes.

If the value of the prizes to be awarded in a raffle exceeds 10000 or if the raffle ticket price exceeds 1000 further regulations apply including detailed disclosure requirements to be printed on the raffle ticket or in a written notice given to the purchaser prior to the sale. Raffles and bingo tickets for raffles and bingo sold by an eligible entity are GST-free as long as the holding of the raffle or bingo event does not contravene a state or territory law. Marys Oratory is a 501c3 receipts are not available for the donation because IRS tax code does not consider raffle tickets tax deductible.

Hilby says that even though St. You cannot deduct the costs incurred in order to support a nonprofit organization through a raffle. Some donations to charity can be claimed as tax deductions on your individual tax return each year.

You can also claim travel to your registered tax agent you are limited per income tax return to 5000km in total across the entire return if claiming the ckm method. Fees paid to a registered tax agent like HR Block for preparation of your return amendments and generally handling your tax matters are all deductible. The revenue ruling holds that the purchasers of the raffle tickets may not deduct the cost of the tickets as charitable contributions under IRC 170.

Raffle or art union tickets for example an RSL Art Union prize home items such as chocolates mugs keyrings hats or toys that have an advertised price the cost of attending fundraising dinners even if the cost exceeds the value of the dinner. Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. No lottery tickets are not able to be claimed as a tax deduction.

You are engaging in a form of gambling not actually donating funds to a charitable foundation but merely betting that youll win the lottery. For a donation to be tax deductible the organisation has to be endorsed by the Australian Tax Office ATO as a Deductible Gift Recipient DGR. Are raffle tickets tax-deductible.

Site protected by. Are raffle tickets tax deductible Australia. Please use the ACNC Charity Register to determine if a charity has received DGR approval.

Are Raffle Tickets Tax-Deductible. First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction. An affidavit of eligibility provided by special olympics arizona may be required from prize winners.

There has never been a better time to enter a Red Cross raffle. Some donations to charity can be claimed as tax deductions on your individual tax return each year. Raffle tickets and lottery syndicates.

Are raffle tickets tax deductible IRS. Such as a raffle ticket. Basically if you receive something because of your donation then dont claim the donation as a tax deduction.

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets. Charity donations of 2 or more to Australian Red Cross may be tax-deductible in Australia. Raffle sponsors keep tickets under wraps.

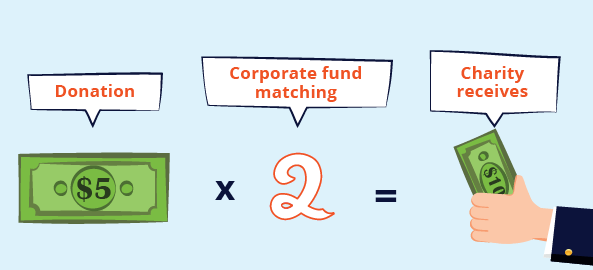

Purchased raffle tickets on a house from an IRC 501c3 organization received a chance to win a valuable prize and therefore received full consideration for the payments. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. Find out about partnerships in New York different tax and liability Jul 07 2015 5 min read.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. 330324 b of melbourne vic 3207 No under current australian government taxation legislation the cost of raffle tickets is not tax deductible.

The IRS considers a raffle ticket to be a contribution from which you benefit. Are raffle prizes considered income. Partnerships offer simple tax structures with unique liability advantages.

Are Lottery Tickets Tax Deductible In Australia Ictsd Org

How To Claim A Tax Deduction On Christmas Gifts And Donations

How To Claim Tax Deductible Donations On Your Tax Return

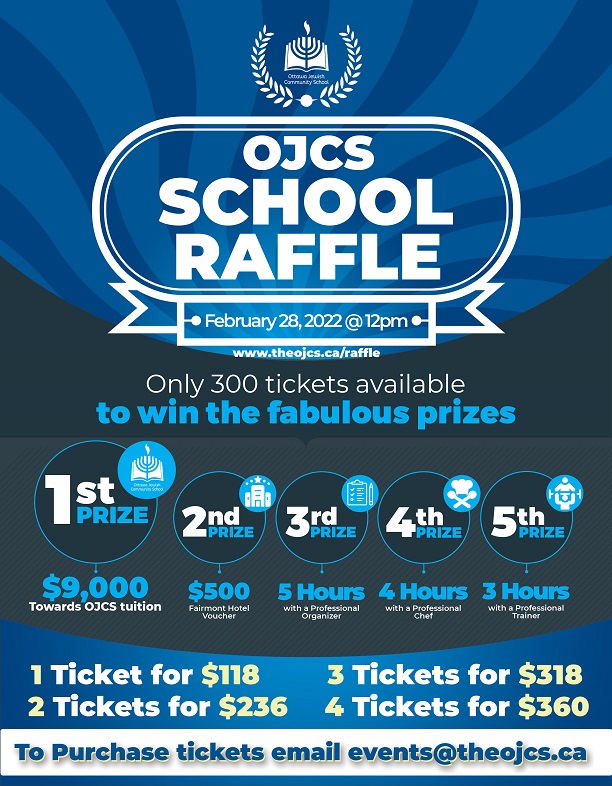

Get Your Tickets For The Ojcs School Raffle The Ottawa Jewish Community School

Are Charity Auctions Tax Deductible Australia Ictsd Org

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Are Raffle Tickets Tax Deductible Australia Ictsd Org

Cornhole Tournament To Benefit Relay For Life Follow Us On Twitter Lynne Schneider For Life Of Vinings Smyrna Ga Relay For Life Relay Cornhole Tournament

How To Make Charitable Donations Really Count Niche Charitable Donations Donate Charitable

Marketing Outreach Plan Template Unique Donation Letter Raffle Ideas Pinterest Donation Letter Donation Letter Template Donation Letter Samples

Tax Deductible Charities Tax Deductible Donations Irs 526 Tax Deductions Charity Donate

Sofii Inmemoriam Donation Thankyou Letter Samples Inside Bequest Letter Template Donation Letter Template Thank You Letter Sample Thank You Letter Template

How To Claim Tax Deductible Donations On Your Tax Return

Are Raffle Tickets Tax Deductible Taxestalk Net

How To Claim Tax Deductible Donations On Your Tax Return

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org